CAC40 in the Eye of a “Perfect Storm”: Why the French Engine is Stalling

While German equities continue to notch record highs, France—the Eurozone’s other primary engine—is facing an unprecedented crisis of investor confidence. Standing at the 8,030-point threshold, the CAC40 index no longer reflects sustained prosperity; instead, it signals a market teetering on the edge of turmoil.

A record-breaking government debt burden, persistent political instability, and looming social unrest are converging into a “perfect storm.” For astute investors, the current climate suggests a defensive stance, or even a strategic window to consider shorting the French market.

The €3 Trillion Debt Straitjacket

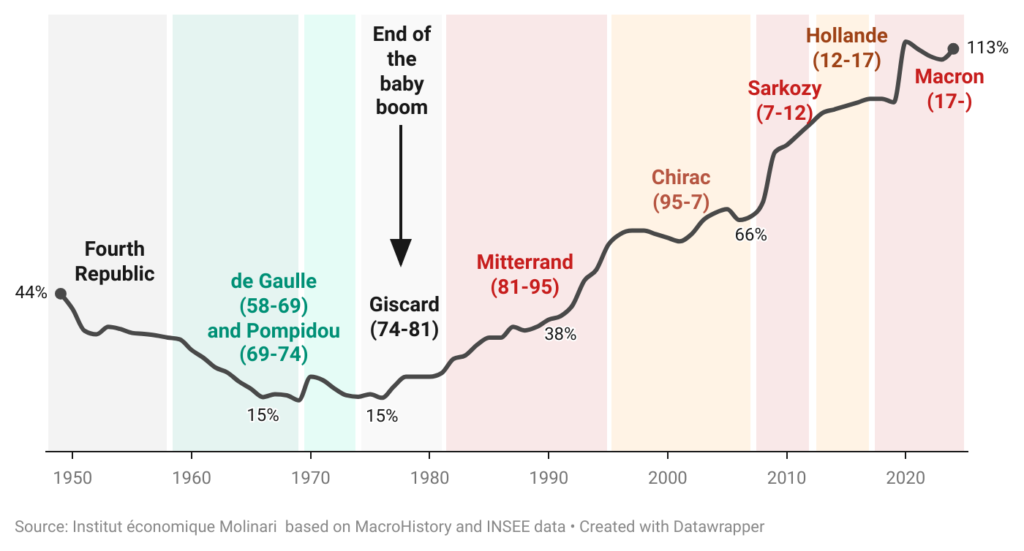

France’s fundamental vulnerability lies in its staggering €3 trillion public debt. This isn’t just a statistical milestone; it is a structural shackle that severely limits the government’s fiscal maneuverability.

- Credit Rating Risks: Fitch Ratings is poised to reassess France’s AA- sovereign credit rating. Any downgrade would immediately spike borrowing costs and intensify budgetary pressures.

- The Transmission Effect: Financial shocks in the bond market transmit directly to equities. As yields rise, the valuation of the CAC40 inevitably comes under downward pressure.

Political Quagmire: Eroding Market Trust

The political landscape in France has entered a period of extreme disarray. Rapid turnover in leadership and failed coalition negotiations have paralyzed crucial economic reforms.

Markets generally loathe uncertainty, and capital is already “voting with its feet.” During recent confidence votes, France experienced a classic “equity-bond double sell-off”: the CAC40 plunged while the yield spread between French and German bonds surged. This divergence highlights a massive flight to safety as international investors flee unquantifiable political risks.

Social Fractures and Economic Disruption

Beyond macroeconomics, grassroots tensions are reaching a boiling point. The planned deployment of 80,000 police officers to manage anti-government “Total Blockade” protests underscores the severity of the situation.

For the CAC40, civil unrest is an economic threat. Widespread disruption hampers business operations, erodes consumer confidence, and triggers panic-driven capital flight. In such a climate, the risk of a “flash crash” in consumer-facing sectors becomes a distinct possibility.

Market Divergence: The “Scissors Gap”

Institutional data reveals a clear preference for stability. This year, Germany’s DAX has surged by 33%, while the CAC40 has trailed behind with a gain of only 23%.

Signs of Weakness:

- Relative Underperformance: The CAC40 consistently lags behind the pan-European STOXX 600 index.

- Banking Sector Fragility: French heavyweights like Société Générale often lead European bank stocks lower during volatility, serving as a barometer for systemic risk within France’s financial system.

Trading Strategy: Identifying the Short Opportunity

Technically, the 8,030 level represents an extremely fragile high. The upside potential appears capped, while the downside remains wide open.

Technical Analysis:

- Resistance: The 8,030 – 8,100 area is a formidable barrier. Failure to breach the October high (~8,232) confirms a “lower highs” bearish downtrend.

- Support: Immediate targets for the downside are 7,700 (the August low) and 7,550.

Strategic Recommendations:

- Direct Shorting: Aggressive traders might consider shorting the CAC40 on rallies within the 8,000–8,100 range, using a stop-loss above 8,250.

- The Pairs Trade: A long DAX / short CAC40 strategy allows investors to hedge against general European risk while profiting specifically from the divergence between a stable Germany and a struggling France.

Risk Warning: Any surprise fiscal support from the EU or a sudden breakthrough in political deadlock could trigger a sharp “short-covering” rally.

Summary and Key Takeaways

The French equity market is currently ensnared by its own structural flaws. Massive debt is the “chronic illness,” political chaos is the “acute crisis,” and social unrest is the “complication.” At current levels, the risk-reward ratio for the CAC40 leans heavily toward the downside.

Frequently Asked Questions (FAQ)

Q1: Why is the CAC40 underperforming compared to the German DAX?

The CAC40 is weighed down by France’s high debt-to-GDP ratio and extreme political volatility. In contrast, Germany’s DAX is viewed as more fiscally stable and benefits from a more predictable political environment, leading to the current “scissors gap” in performance.

Q2: How does a sovereign credit rating downgrade affect the CAC40?

A downgrade by agencies like Fitch increases the perceived risk of French debt. This leads to higher interest rates for the government and corporations, which increases borrowing costs and reduces corporate profit margins, typically causing the CAC40 to drop.

Q3: What are the key support levels to watch for the CAC40 if the rally fails?

If the index fails to hold its current levels, the first major support is at 7,700 (the August low). A break below that would likely lead the index toward the 7,550 level, which represents a critical psychological and technical floor.

Q4: Can social unrest actually cause a market crash?

While social unrest rarely causes a total crash on its own, it acts as a “catalyst.” It disrupts logistics, lowers retail sales, and signals to international investors that the country is unstable, often leading to a rapid withdrawal of capital that triggers a sharp sell-off in the CAC40.