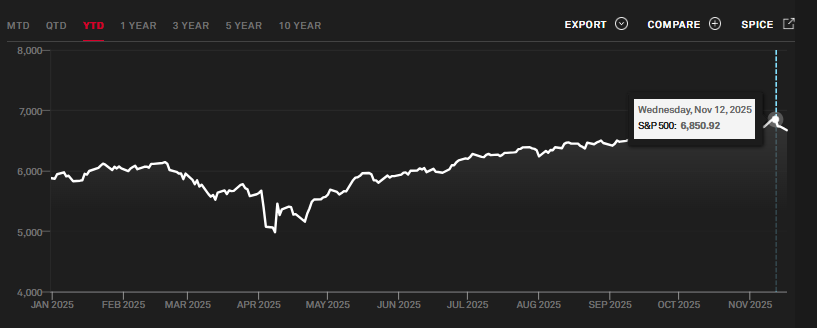

The S&P 500 Index has exhibited a pronounced upward trend throughout November 2025, fueled by robust corporate performance, expectations of monetary easing, and sustained investor enthusiasm for the technology sector. The recent ascent has established strong technical support levels, positioning the index for a potential push toward the significant 7000 psychological and technical milestone.

Performance Highlights

Over the past month, the S&P 500 has posted a substantial overall gain of approximately 2.95%. This impressive climb underscores resilient market fundamentals and strong positive sentiment among investors. Despite a brief period of volatility earlier in the month, the index has successfully navigated above the crucial 6800 level, indicating robust buying interest and setting the stage for a near-term test of higher resistance. This upward trajectory is particularly notable given the recent, albeit limited, impact of macro-level uncertainties, including the longest US government shutdown on record.

Key Market Dynamics Powering the Rally

The current market momentum is driven by a convergence of powerful fundamental factors:

- Monetary Policy Expectations: A primary catalyst remains the strong expectation among market participants that the Federal Reserve will continue its accommodating stance. Prospects of further interest rate reductions have amplified risk appetite, driving capital toward equities, particularly high-growth and technology stocks that benefit significantly from lower borrowing costs.

- Corporate Profitability: Underlying fundamental support is strong, with the majority of S&P 500 companies reporting third-quarter earnings that surpassed analyst forecasts. This sustained corporate strength is underpinned by continued resilient consumer spending, reinforcing investor confidence in current equity valuations and forward guidance.

- Technology Sector Leadership: The dominance of the “Magnificent 7” technology firms and the massive capital inflow into artificial intelligence (AI) innovation are pivotal drivers. Due to the high index weighting of these firms, their ongoing innovation and strong performance have been essential to the index’s overall appreciation. Investor eagerness to capitalise on AI-driven growth opportunities continues to fuel the rally’s vigour.

- Limited Impact of Government Closure: The protracted US government shutdown in November 2025 had a surprisingly muted effect on the broader market. The subsequent passage of a stopgap funding bill quickly alleviated investor concerns. Market sentiment remains focused on the expectation that postponed economic activity and federal employee compensation will rapidly normalize, offsetting any temporary adverse effects.

Technical Analysis: Levels and Indicators

From a technical standpoint, the current price action validates the strength of the bullish trend.

Support and Resistance Levels

The index has successfully established the 6800 level as a reliable support floor, demonstrating institutional commitment to maintaining price stability above this threshold. While the 6500 area serves as a significant secondary support zone, current market strength suggests a retreat to this level is unlikely in the immediate term. The key objective for the bulls is the 7000 level, which represents both a psychological barrier and a critical technical resistance target. A conclusive break above 7000 could unlock a significant acceleration in price appreciation.

Trend Indicators

- Moving Averages: The short-term trend, indicated by key moving averages like the 20-day Simple Moving Average (SMA), confirms positive momentum. The index is trading firmly above these benchmarks, validating the persistence of the upward trend.

- Momentum Oscillators: Indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) signal robust underlying strength. The RSI is currently situated in a healthy zone, indicating that there is still room for further upside potential before the market enters historically overbought conditions that would necessitate a major correction.

Volatility and Pullbacks

While the upward trajectory is dominant, intermittent profit-taking and pullbacks are normal and expected in any market cycle. Technical analysis suggests that these temporary retreats are more likely to present attractive buying opportunities for long-term investors rather than signaling a comprehensive trend reversal, given the strong fundamental catalysts supporting the rally.

Outlook: Path to 7000 and Beyond

The S&P 500’s trajectory in the coming weeks will be highly dependent on several interconnected factors:

- Confirmation of the Federal Reserve’s dovish pivot, specifically regarding the timeline and size of future interest rate cuts.

- The continued delivery of exceptional corporate earnings and sustained positive economic data.

- The evolution of geopolitical stability and domestic fiscal developments.

- Investor appetite for high-growth, innovation-led sectors, particularly the scale of expenditure and adoption within artificial intelligence.

Should these conditions remain supportive and the overall market structure hold, the most probable scenario is a continuation of the current bullish phase. A decisive daily or weekly close above the 6910 to 6930 resistance cluster would confirm the renewed strength and clear the path for the index to advance toward the next key psychological level at 7000 and potentially push further into new territory.

FAQ: S&P 500 Analysis

Q1: What is the main reason for the S&P 500’s recent strong performance?

The primary drivers are the expectation of further interest rate cuts by the Federal Reserve, robust corporate earnings reports that exceeded analyst forecasts, and continued strong investor enthusiasm for technology and AI-related stocks.

Q2: Which technical level is acting as the most important support floor right now?

The 6800 level has been established as a crucial and reliable support floor. The index has maintained stability around this mark, signaling strong underlying buying demand.

Q3: What significance does the 7000 level hold for the S&P 500?

The 7000 level is a major target as it acts as both a significant psychological barrier and a key technical resistance point. Breaking decisively above this level is expected to fuel accelerated bullish momentum.

Q4: How did the US government shutdown impact the market in November?

The US government shutdown had a surprisingly limited and temporary impact on the S&P 500’s overall trajectory. Investor sentiment quickly rebounded following the passage of a funding bill, with markets expecting a swift recovery in economic activity.