Is Ethereum Headed to $2,000? Analyzing the Convergence of Bearish Catalysts

Ethereum is facing several forces that could drive its price downward in the upcoming month despite some historical patterns favoring November gains. Key downward pressures include technical bearish signals, market liquidations, macroeconomic uncertainties, and recent negative news amidst a cautious investor sentiment.

Macroeconomic Uncertainty and Fed Policy Risks

The U.S. Federal Reserve’s December 9-10 meeting represents a critical inflection point, with market expectations for a rate cut swinging between 39% and 85% in recent weeks. A “hawkish pause”—maintaining current rates amid persistent inflation and robust employment data—could spark a broad risk-off selloff, strengthening the dollar while draining liquidity from high-volatility assets like ETH.

Additional macroeconomic pressures amplify this risk: While the Fed’s quantitative tightening program concludes in December, a shift to a neutral stance without additional stimulus could drive capital toward safer havens. Overlapping global uncertainties—including U.S. tariff policies, concerns over an AI investment bubble, and economic deceleration across Europe and Asia—have already weakened ETH’s correlation with the Nasdaq. However, in a broader downturn, this relationship could reassert itself and pull ETH lower. Analysts estimate a no-cut scenario could erase 10-20% of ETH’s value, testing the $2,300 support level as investors rotate to defensive positions. Even if a rate cut materializes, its delayed transmission to crypto markets may fail to halt near-term losses, particularly as Bitcoin’s market dominance continues to rise at the expense of underperforming altcoins.

Institutional Pullback and ETF Redemption Pressures

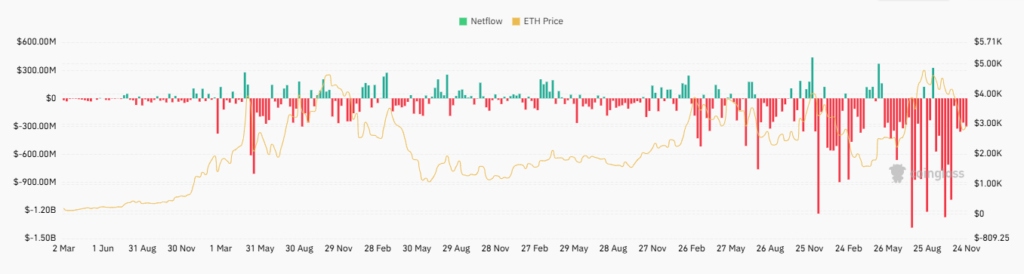

Institutional flows, once a source of strength, now present a considerable headwind. Ethereum ETFs experienced over $1.4 billion in net outflows during November, creating sustained selling pressure and expanding circulating supply. This exodus could intensify in December if macroeconomic indicators disappoint, as funds including BlackRock’s face redemptions driven by profit-taking or rotations into Bitcoin ETFs. Market analysts warn that failure to maintain the $2,800 level could trigger a self-reinforcing cycle of forced liquidations and accelerating outflows.

Large holder behavior compounds these concerns: Long-term ETH holders have been distributing an average of 45,000 ETH daily since August—a pace likely to increase as December brings year-end tax-loss harvesting and portfolio re-balancing. Treasury-holding entities trading at significant discounts may liquidate positions under debt pressures, adding downward momentum. Without meaningful capital inflows—improbable given “extreme fear” readings in sentiment indicators—analysts project ETH could decline an additional 15%, potentially mirroring Bitcoin’s projected retreat toward $75,000. Regulatory ambiguity further dampens institutional appetite: evolving SEC positions on staking could postpone initiatives like BlackRock’s planned ETH staking product, extending the outflow cycle and delaying any recovery in institutional demand.

ETH Spot Inflow/Outflow

On-Chain Weakness and Technical Vulnerabilities

On-chain metrics present a troubling landscape with potential for further deterioration. While ETH’s staking rate holds steady at 54%, emerging unstaking pressures—driven by diminishing yields and competing opportunities—threaten to release substantial supply into the market. Exchange reserves have contracted 30% since July, yet any reversal triggered by panic selling could rapidly increase available supply and intensify downward price pressure. Technical indicators reinforce this bearish outlook: ETH remains confined within a descending channel, with the Relative Strength Index hovering at oversold levels (31-35)—suggesting exhaustion but insufficient momentum for reversal. A bearish rounded top formation warns of a potential decline to $2,230 should the critical $2,800 support level fail.

The December 4 Fusaka upgrade, designed to reduce Layer-2 transaction costs through expanded blob capacity, introduces execution risk. Implementation challenges or sluggish adoption could undermine market confidence, echoing setbacks from previous upgrade delays. Liquidation vulnerabilities remain elevated: November’s $19 billion in liquidations demonstrated market fragility, and shallow order book depth could amplify cascading liquidations in December if leveraged positions accumulate. Despite bearish funding rates and oversold conditions hinting at potential short-term relief rallies, the absence of meaningful volume suggests ETH may continue gravitating toward $2,600 or lower Fibonacci retracement levels.

Market Sentiment and External Catalysts

Market sentiment has reached “extreme fear” territory, with the Fear & Greed Index registering 10-15—a level that typically perpetuates self-reinforcing selling cycles. Social media discourse underscores this pessimism, as ETH approaches its longest consecutive monthly decline streak since the 2018 bear market. Meanwhile, competitive pressure from alternative platforms like Solana and Binance Smart Chain continues to siphon capital and fragment Ethereum’s market share. Security concerns persist following November’s $128 million Balancer exploit, with any subsequent breaches likely to further erode confidence.

External catalysts present additional downside risks: A Bitcoin decline toward $80,000 or lower—potentially triggered by adverse Fed policy outcomes—would likely exert disproportionate pressure on ETH given its historically higher beta to market movements. Systemic threats including stablecoin depegging events or major DeFi protocol failures could spark contagion across the broader ecosystem. Regulatory developments, whether from the EU’s MiCA framework or evolving U.S. policy positions, may impose new compliance requirements that dampen market activity. Under sustained fear-driven sentiment, analysts project ETH could test the $2,000 threshold, with volatility remaining elevated throughout this period.

Bearish Outlook and Potential Mitigations

Under a bear-case scenario, the confluence of these pressures could drive ETH 20-30% lower by month-end, with critical support levels at $2,000-$2,300 facing severe tests. However, several countervailing factors merit consideration: A December Fed rate cut could restore liquidity to risk assets, successful Fusaka implementation may accelerate Layer-2 adoption and strengthen Ethereum’s competitive position, and strategic accumulation by large holders during price dips—already observed in recent months—could establish price floors.

From a longer-term perspective, Ethereum’s deflationary tokenomics following the Merge and its entrenched position in DeFi infrastructure provide fundamental support for eventual recovery. Yet the near-term balance of risks for December skews decidedly bearish. Prudent investors should prepare for heightened volatility while recognizing that significant drawdowns may present strategic entry points for those with conviction in Ethereum’s fundamentals and appropriate risk tolerance. This period serves as a stark reminder of crypto market fragility—disciplined risk management and careful position sizing remain essential.