Building wealth no longer depends solely on working harder. In 2026, the smartest investors are finding ways to make money work for them. Passive income ideas are gaining popularity as more people seek financial freedom and flexibility. Whether you’re a beginner or a seasoned investor, learning how to generate passive income can help you create stability in an uncertain economy.

Understanding the Power of Passive Income

Passive income refers to money earned with minimal effort after the initial setup. Unlike active income, where you trade time for money (like a salary), passive income allows you to earn continuously even while you sleep.

Common sources include investments, royalties, digital products, and business systems that run without constant supervision. According to Forbes, successful investors combine multiple passive income streams to diversify earnings and reduce financial risk.

Why Passive Income Matters in 2026

The importance of generating money passively is growing due to several macro trends:

- Economic Uncertainty: Volatile economies push individuals to seek financial independence and reliable secondary cash flows.

- Technological Automation: Advances in Fintech and automation make it easier than ever to set up and manage income streams with minimal time investment.

- Global Accessibility: Global investment platforms, such as those that support trading multiple asset classes, allow beginners to explore sophisticated investment options from a single account.

- Rising Inflation: Finding income sources that grow faster than expenses is crucial for preserving and growing purchasing power.

Building multiple income streams is no longer optional; it’s a vital strategy for long-term financial resilience.

Top Passive Income Ideas 2026 for Every Investor

As automation, digital entrepreneurship, and global investment tools expand, new opportunities continue to emerge. Here are 10 of the most practical and profitable passive income ideas 2026 investors should consider, catering to different capital and risk appetites.

1. Dividend Investing 📈

One of the most reliable ways to earn passive income is through dividend-paying stocks or Exchange-Traded Funds (ETFs). Companies share a portion of their profits with shareholders regularly.

- How it Works: Investing in blue-chip companies or ETFs that pay consistent quarterly dividends.

- Why it’s Passive: Dividend reinvestment automatically compounds your wealth, providing both steady cash flow and potential capital appreciation over time. Modern trading platforms such as Ultima Markets provide advanced tools for both active and passive traders.

2. Digital Products and Online Courses 💻

Creating and selling digital products is one of the fastest-growing passive income ideas. Once produced, e-books, templates, or online courses can sell repeatedly with little maintenance.

- How it Works: Launching an educational course about trading, investing, or specific digital skills.

- Why it’s Passive: Digital products scale globally without needing physical inventory or shipping logistics.

3. Real Estate Investment Trusts (REITs) 🏢

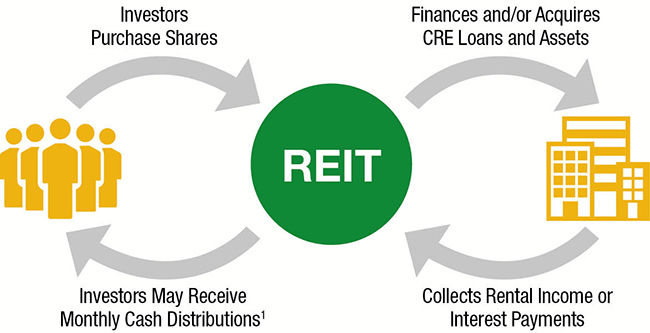

If you prefer a completely hands-off way to invest in property, REITs offer an accessible alternative. They pool investor money to purchase income-producing assets like apartments, hotels, or data centers.

- How it Works: Purchasing shares of a REIT listed on major stock exchanges.

- Why it’s Passive: REITs are legally required to distribute most of their profits as dividends, creating consistent passive returns without requiring you to be a landlord.

4. Affiliate Marketing 🔗

Affiliate marketing remains one of the most accessible passive income ideas for beginners. You earn commissions by promoting products or services online.

- How it Works: Starting a blog, YouTube channel, or social media account that shares honest product reviews and includes affiliate links.

- Why it’s Passive: Once your content ranks in search engines or gains views, it continues generating income even months after the initial posting.

5. Investing in Forex and Copy Trading 🤖

Modern trading platforms provide advanced tools for both active and passive traders. Copy trading allows beginners to automatically mirror the strategies of verified professional traders.

- How it Works: Linking your trading account to an expert whose trades are replicated in real time.

- Why it’s Passive: You can potentially generate income from market movements without constantly monitoring charts or developing complex strategies.

6. Peer-to-Peer (P2P) Lending 🤝

Fintech platforms have opened new doors for investors who want to earn interest by lending money directly to vetted borrowers.

- How it Works: Joining P2P lending sites that connect lenders and borrowers, allowing you to earn fixed interest on your contributions.

- Why it’s Passive: Investors earn higher returns than traditional bank savings while diversifying income sources across multiple small loans.

7. Automated E-Commerce (Dropshipping) 📦

E-commerce no longer requires managing inventory or shipping logistics. Dropshipping and print-on-demand services have made it possible for beginners to launch stores easily.

- How it Works: Creating an online store that sells custom products fulfilled automatically by third-party suppliers.

- Why it’s Semi-Passive: Automation tools handle orders and fulfillment, minimizing the time needed for daily operations.

8. Real Estate Crowdfunding 🏘️

Real estate remains a cornerstone of wealth creation, but digital crowdfunding allows anyone to invest in properties without needing massive initial capital.

- How it Works: Joining real estate investment platforms that pool funds to buy shares in rental or commercial properties.

- Why it’s Passive: Investors earn returns through rental income and property appreciation while professionals handle the intensive management duties.

9. High-Yield Savings and Bonds 🛡️

While not the highest-return option, fixed-income instruments still play a critical role in secure wealth-building.

- How it Works: Investing in government treasury bonds, money market funds, or online high-yield savings accounts.

- Why it’s Passive: These investments provide highly predictable, steady income with minimal risk, making them ideal for conservative investors.

10. Selling Stock Photos or Creative Assets 🖼️

Photographers, designers, and artists can monetize their skills by selling assets on online platforms.

- How it Works: Uploading stock images, illustrations, or music files to royalty-free websites that pay per download or subscription.

- Why it’s Passive: Once uploaded, the creative content continues generating revenue indefinitely without any extra effort or maintenance.

How to Choose the Right Passive Income Stream

Not all passive income ideas suit every investor. Choosing the right one depends critically on your time, budget, and risk appetite.

| Key Consideration | Description |

| Capital Requirement | Ideas like real estate or high-end trading need higher capital, while affiliate marketing requires more time and skill/creativity. |

| Risk Tolerance | Evaluate how much market volatility you can handle. Blend low-risk instruments (bonds, REITs) with growth-driven ones (stocks, digital assets). |

| Skill Alignment | Choose opportunities that align with your existing expertise (e.g., design skills for selling creative assets, writing skills for a blog). |

| Time Horizon | Passive income takes time to build. Focus on consistency and reinvestment rather than quick results. |

Building Sustainable Passive Income in 2026

To build lasting wealth, you must treat passive income generation like a structured, goal-oriented business.

- Set Realistic Targets: Define clear income goals for the next 6 to 12 months.

- Automate Reinvestment: Use automated tools to systematically reinvest dividends or interest earned.

- Diversify Sources: Balance conservative and high-return options to hedge against sector-specific risks.

- Educate Yourself: Continuously read reliable finance resources to stay ahead of market trends.

- Track Performance: Review monthly returns, analyze cash flow, and adjust your strategy as markets evolve.

As 2026 unfolds, those who combine strategy, patience, and smart reinvestment will lead the new wave of financial independence.

Summary and Key Takeaways

Building passive income is not about luck; it’s about structure and patience. The best passive income ideas 2026 empower individuals to take control of their financial futures, regardless of background or experience.

Key Takeaways

- Passive income ideas help achieve long-term financial stability.

- Passive income ideas for beginners include Affiliate Marketing, REITs, and Dividend Investing.

- The top 2026 opportunities reflect technology-driven growth and global accessibility.

- Education, automation, and platform accessibility are key to sustained results.

- Reliable platforms like Ultima Markets make it easier to explore diversified investment options.

“If you don’t find a way to make money while you sleep, you will work until you die.” — Warren Buffett

With the right foundation, 2026 could be the year your money starts working harder than you do.

Frequently Asked Questions (FAQ)

Q1: What is the main difference between passive and active income?

A: Active income involves a direct exchange of your time and effort for money (e.g., a salary or hourly wage). Passive income requires significant effort upfront to set up (e.g., creating an online course or investing capital), but then generates ongoing revenue with minimal additional time commitment.

Q2: How much initial capital do I need to start generating passive income?

A: The required capital varies significantly. Some options, like Affiliate Marketing or selling Stock Photos, can start with little to no capital, primarily requiring time and skill. Others, like Real Estate Crowdfunding or high-yield Bonds, require a higher initial investment of money. It is best to start with an option that matches your current budget.

Q3: Is “Copy Trading” truly passive income, or does it require management?

A: Copy Trading is considered a semi-passive income stream. Once you link your account to a professional trader, the execution of trades is automated (passive). However, it requires active monitoring of the expert’s performance, assessing the risk, and adjusting your allocation or changing the copied trader, which requires minimal, but crucial, management time.

Q4: What is the biggest risk when pursuing passive income through digital products?

A: The biggest risk is the time investment failure. Digital products require a large amount of time and effort upfront for creation and initial marketing. If the product does not resonate with the market or fails to rank online, the initial time investment may not generate the expected passive returns. This contrasts with investments like bonds, where the risk is primarily related to capital.